Let our experienced professionals help you with a flexible commercial mortgage. Loans from 100k to 2.5 Million.

When should you choose an alternative solution for your commercial deals?

Freedom Legacy Lending Program Overview

Lock in the best rate possible. Great for credit-worthy clients.

Skip the tax returns. For borrowers who need more flexibility on investor deals.

Borrowers can qualify for financing without submitting tax returns, bank statements or operating statements.

Designed for self-employed borrowers. This solution lets you procure financing with just 12 months of business bank statements.

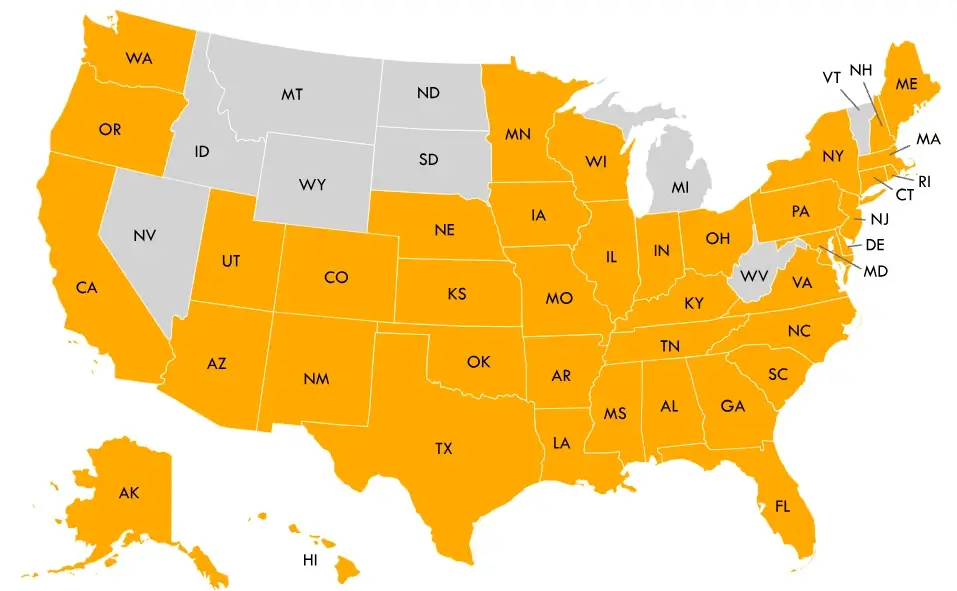

DISCLAIMER: Programs not available in the following states: Nevada, Idaho, Montana, Wyoming, North Dakota, South Dakota, Michigan, West Virginia and Vermont. All information contained herein is for informational purposes only and, while every effort has been made to insure accuracy, no guarantee is expressed or implied. Any programs shown do not demonstrate all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval.