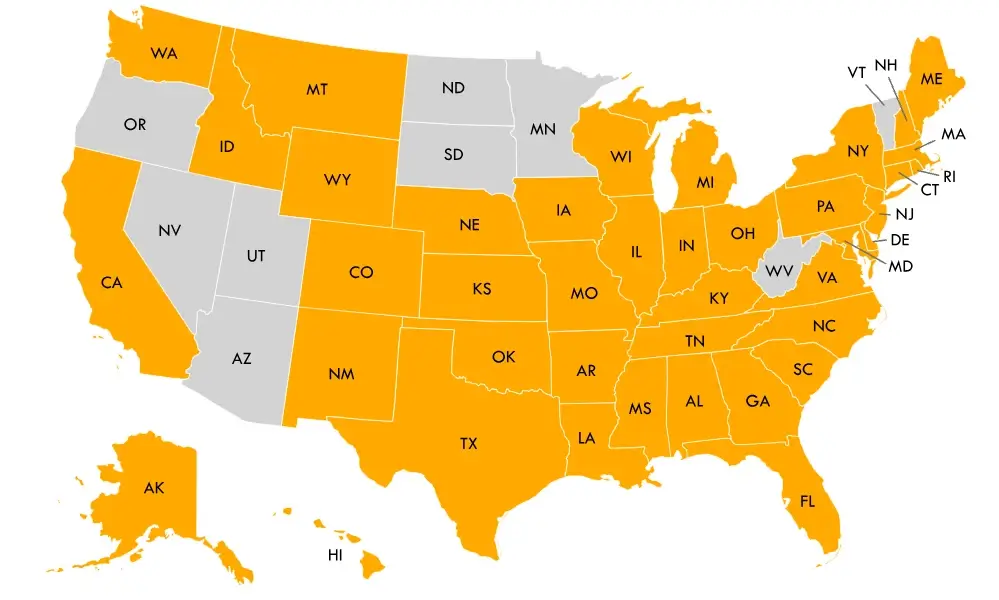

DISCLAIMER: Programs not available in the following states: Arizona, Minnesota, Nevada, North Dakota, Oregon, South Dakota, Utah, Vermont and West Virginia. All information contained herein is for informational purposes only and, while every effort has been made to insure accuracy, no guarantee is expressed or implied. Any programs shown do not demonstrate all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval.